Net present value of annuity calculator

Get your exclusive free annuity report. N number of periods.

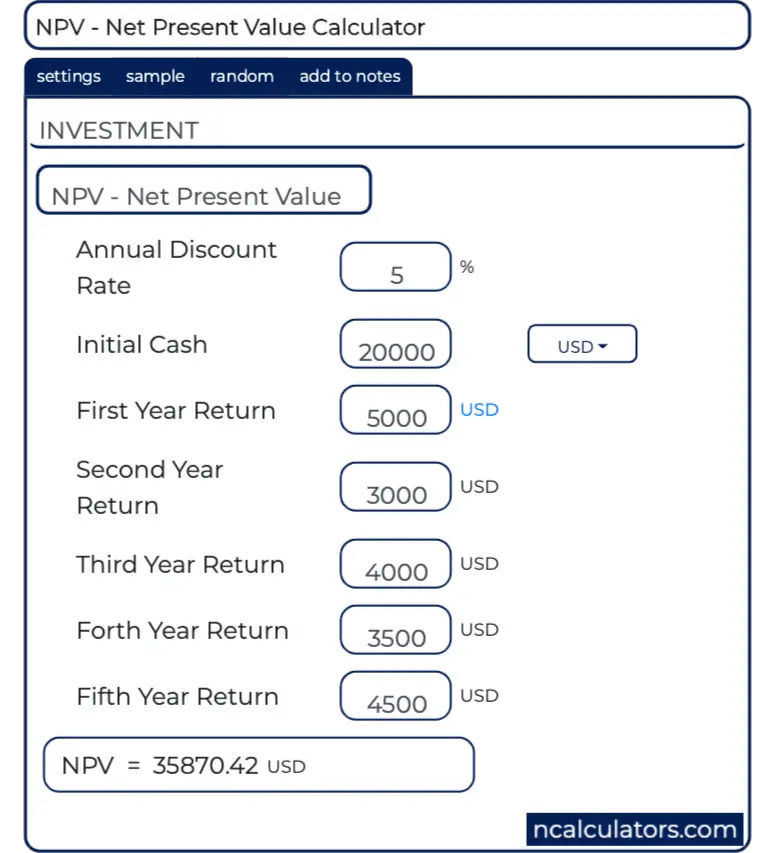

Net Present Value Npv Calculator

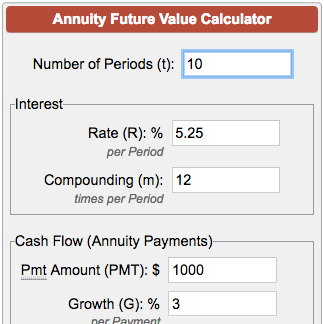

It uses a payment amount number of payments and rate of return to calculate the.

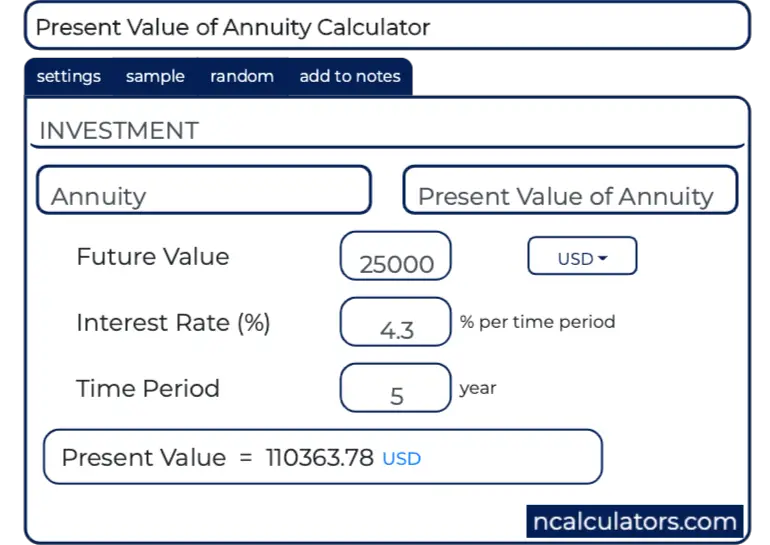

. Present Value Of An Annuity. The annuity may be either an. PV of Annuity Calculator Click Here or Scroll Down The present value of annuity formula determines the value of a series of future periodic payments at a given time.

The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. N the number of cycles. Ad Annuities help you safely increase wealth avoid running out of money.

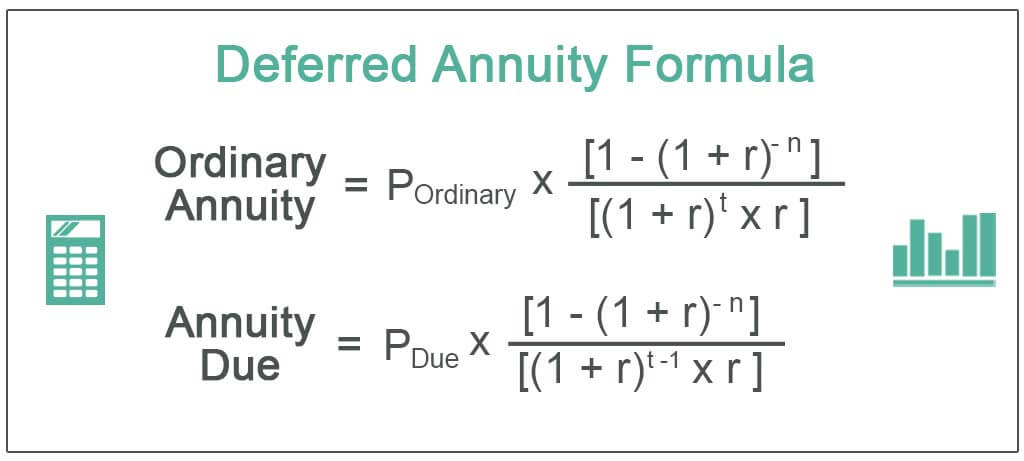

C 1 cash flow at first period. Present Value of Annuity is calculated depending on the annuity type - In ordinary. The algorithm behind this present value of annuity calculator is based on the formulas explained as follows.

The higher the discount rate the lower the present value of the annuity. PV FV 1r n. The present value PV of an annuity is the value today of a series of payments in the future.

Ad Fixed Annuity is an Insurance Product Designed to Provide Long-Term Tax-Deferred Savings. Explore our full range of financial products. PV the Present Value.

Thus this present value of an annuity calculator calculates todays value of a future cash flow. FV This is the. Ad Learn More about How Annuities Work from Fidelity.

A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan. PV of annuity P 1 1 r -n r. The present value of an annuity is determined by using the following variables in the calculation.

If youve got the selection of being paid 1000 today or 1200 one year from now. Build Your Future With a Firm that has 85 Years of Investment Experience. In Excel there is a NPV function that can be used to easily calculate net present value of a series of cash flow.

R rate of return. The present value PV is what the cash flow is worth today. Periodic Payment P.

A simple example of a growing annuity would be an individual who receives 100 the first year and successive payments increase by 10 per year for a total of three years. This would be a. All of this is shown below in the present value formula.

Example of Present Value. So to get the present value of an annuity use the following formula. Periodic interest rate r.

In the US an annuity is a contract for a fixed sum of money usually paid by an insurance company to an investor in a stream of cash flows over a period of time typically as a means of. PV Present value also known as present discounted value is the value on a given date of a payment. Ad We offer a broad range of products to help you reach your investment goals.

In economics and finance present value PV also known as present discounted value is the value of an expected income stream determined as of the date of valuationThe present value. Ad Learn More about How Annuities Work from Fidelity. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

1 The NPV function in Excel is simply NPV and the full formula.

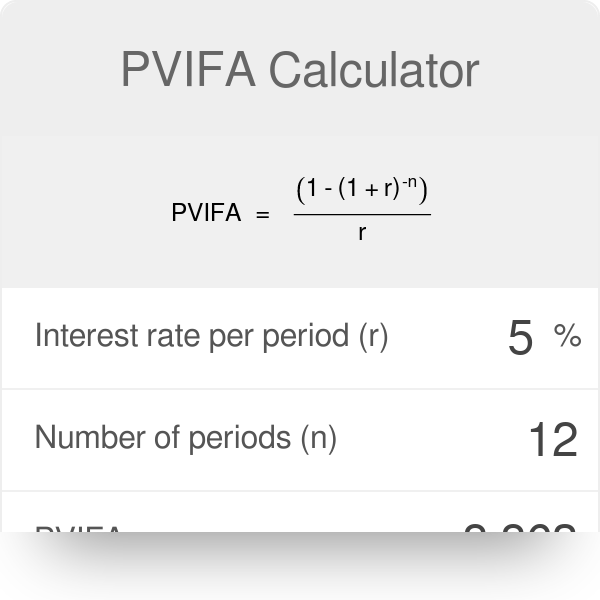

Present Value Annuity Factor Formula With Calculator

Long Term Short Term Investment Planning Calculators

Perpetuity Formula And Financial Calculator

Pvifa Calculator

Future Value Of Annuity Calculator

Net Present Value Npv Youtube

Present Value Of Annuity Youtube

Present Value Of An Annuity Calculator

How To Calculate Annuities Using Excel Present Value Of Annuity For Asset Valuation Youtube

Solve For Number Of Periods On Annuity Pv Formula With Calculator

Calculating Pv Of Annuity In Excel

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

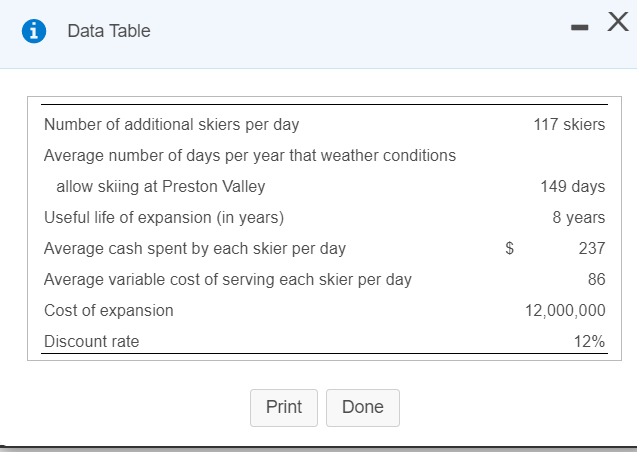

Solved Calculate The Net Present Value Of The Expansion Chegg Com

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Calculating Pv Of Annuity In Excel

%201.gif)

Solve For Number Of Periods On Annuity Pv Formula With Calculator

Microsoft Excel Time Value Function Tutorial Annuities Tvmcalcs Com